Calculating Customer Lifetime Value

The term Customer Lifetime Value (CLV or LTV) has a number of different definitions and approaches. So sitting down to calculate customer lifetime value for your business can be a daunting exercise.

And that’s a real shame.

So we sat down to address how we calculate customer lifetime value to help improve data driven marketing for our users. We kept things simple.

The reason being that we wanted to provide a way to calculate customer lifetime value that could be universally applied and built upon.

We also wanted to create a metric for customer lifetime value that doesn’t need an in-house rocket scientist to explain to the marketing team.

You see once you understand the power of customer lifetime value as a metric. The way you plan and measure your future marketing change – and for the better.

Discover the value of understanding your Customer Lifetime Value?

It’s universally agreed that Customer Lifetime Value (CLV) is the single most important metric for understanding your customers.

Customer Lifetime Value gives you an individual sales report for each individual or business that you deal with.

Having the ability to have an accurate way to calculate customer lifetime value makes a huge difference. It helps you make key business decisions on sales, marketing, product development, and customer support.

For example:

Marketing: Where are my best customers coming from, and how much should I be spending to acquire a customer?

Product Development: What are my best customers buying? How can I tailor or offer products and services around their needs?

Customer Support: How much should I spend to service and retain a customer?

Sales: Are you focusing your sales efforts on the types of customers that are spending the most money with you? You should be.

How do you calculate Customer Lifetime Value?

How you calculate customer lifetime value depends on the complexity of your business, and that often acts as a huge barrier to getting started.

Some consider the most straightforward way to calculate customer lifetime value is to take the revenue you earn from a customer and subtract out the money spent on acquiring and serving them.

But that in itself can be a daunting task, especially for an ecommerce business with a complex and ever changing cost per acquisition metric. See this post on cohort analysis from our friends at Bearded Colonel

We keep customer lifetime value simple and generic.

When we calculate customer lifetime value, it’s as simple as the total spend of each individual customer over their lifetime, divided by the number of customers.

Finding your Customer Lifetime Value

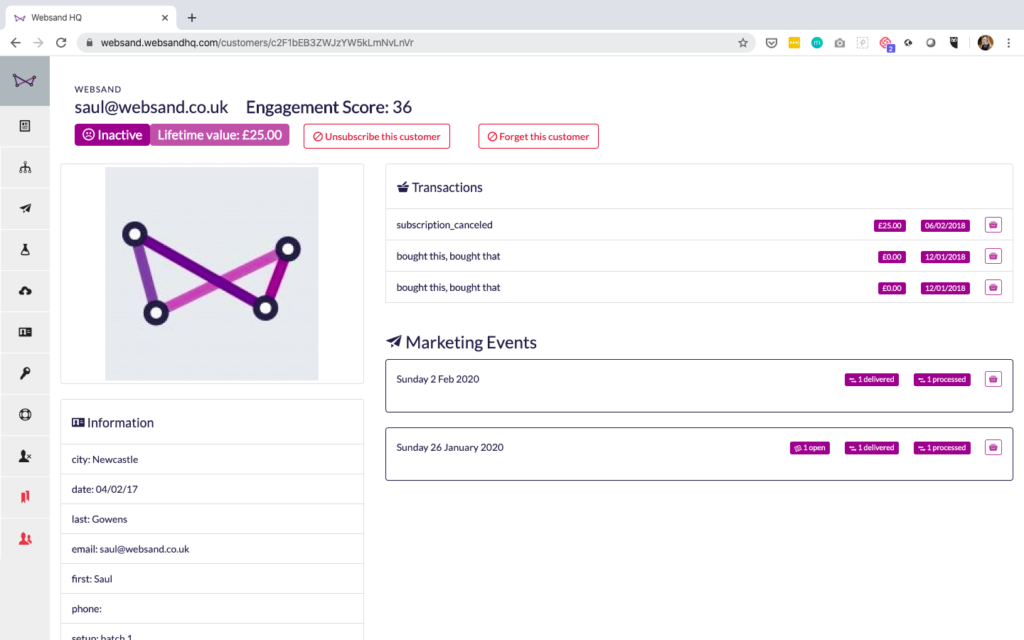

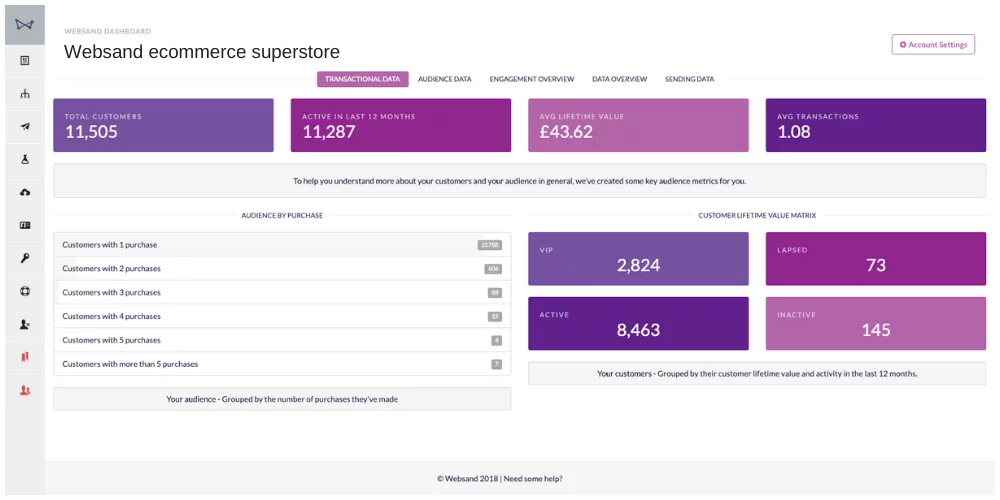

If you are using Websand, we believe that Customer lifetime value is a key measurement that you need to understand. So we’ve made it a key part of our dashboard.

Once your e-commerce store is connected, Websand will collate the spend information for each customer, calculate the Customer Lifetime Value metric for your business and present it front and centre of your Websand dashboard.

We’ve found that having customer lifetime value as a real-life metric can be a real eye opener and gives you a great indication whether things are working or not.

If you want to take this baseline figure and take it deeper, then we can help too. Click here to take a free Websand 14 day trial.

Improve your Customer Lifetime Value

Even a small increase in your Customer Lifetime Value calculation can have a dramatic impact throughout your business.

And the easiest way to improve this metric is apply different strategies to different customer groups based on their ‘value’ to your business.

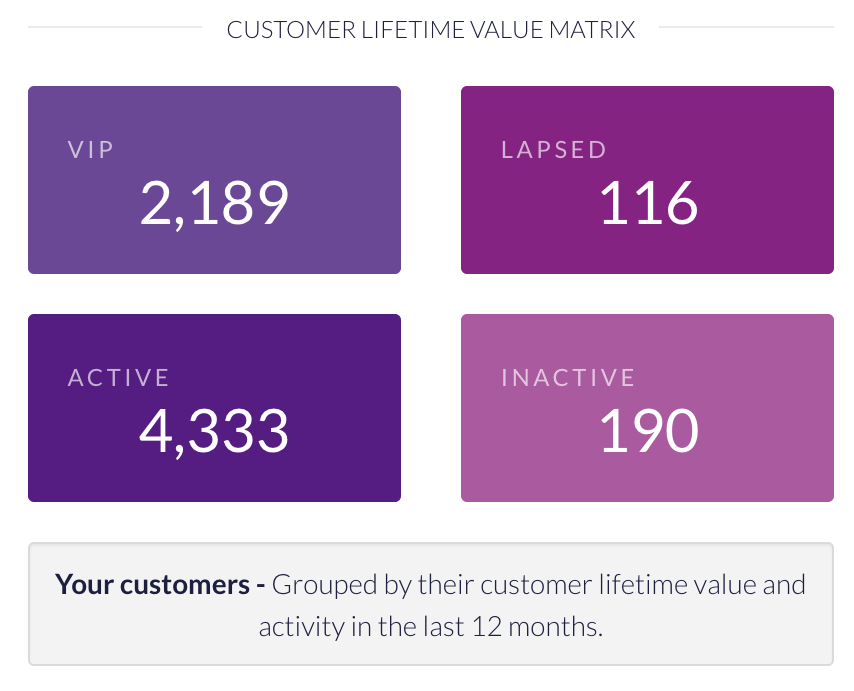

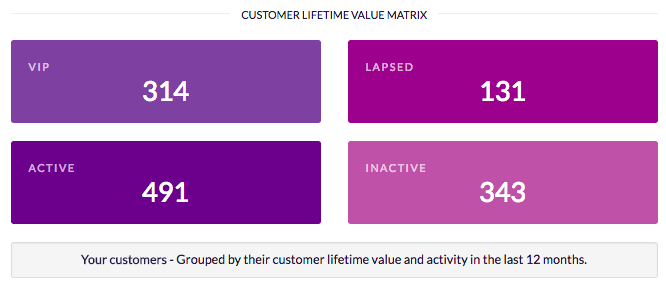

To help apply this, Websand has a built-in customer lifetime value ‘matrix’ (see below).

Again this is front and centre of the dashboard, and updated in real time based on the activity of your customers. Click on the box and a segment for your customers will be created ready for you to create an email marketing campaign, or a marketing automation process.

Find your VIP’s

If customers are active and above your average customer lifetime value, then we consider them your VIP’s.

These are customers that are active and spend a lot of money with you. You want to keep these people happy and retained. Perhaps benefits, perhaps special deals, whatever works best for your business.

Click on the VIP box on the Websand dashboard to create a VIP segment or create your own VIP segment based on a specific customer lifetime value using customer lifetime value segmentation.

Discover which customers have lapsed

If customers were active and above your average customer lifetime value, then we consider these your lapsed customers.

They’ve spend considerable money with you in the past. So it would be reasonable to invest in them and re-awaken them as customers.

Click on the Lapsed box on the Websand dashboard to understand those customers who are worth above the average customer lifetime value but not purchased in the last 12 months.

Who are the new Active customers

These are customers that have recently purchased, but below your average customer lifetime value.

These are most likely to be new customers. So focus here could be to move them to the next purchase. Make these customers your future VIP’s.

Click on the Active box on the Websand dashboard to understand those customers who are worth below the average customer lifetime value and have recently purchased. Or use the customer repeat segmentation function and look to build a customer retention programme following on from someone’s first purchase.

Who are those who are now Inactive customers

Inactive customers, are customers that haven’t spent for a while and didn’t spend much anyway (below your average customer lifetime value).

Usually these customer would be audience targeted for customer churn marketing. However, now we understand our customer lifetime value, and this group hasn’t really demonstrated much.

So rather than be a group to target specifically, the inactive customers could be a group to include in ‘normal’ marketing.

However, understanding the profile of the inactive customers could be extremely valuable. It could be that your best performing sources of customer acquisition are actually producing low value customers.

Click on the Inactive box on the Websand dashboard to understand those customers who are worth below the average customer lifetime value but not purchased in the last 12 months

Unlock the secrets of customer lifetime value within your business

Websand is based on a history of loyalty marketing. Where understanding customer lifetime value is a key metric of understanding and driving business performance.

We think the customer lifetime value metric is so important we’ve pretty much built our marketing automation platform around it. And our customers agree.

Websand helps you unlock the benefits of data driven marketing and calculate customer lifetime value for your business. Click here to book a chat or fill out the form below.

It’s time to start getting more from your email marketing

Sign up for a free Websand demo and let’s show you how to get the best from your email marketing.

Hi, I do believe this is an excellent website. I stumbledupon it 😉 I am going to come back yet again since I bookmarked it. Money and freedom is the best way to change, may you be rich and continue to help other people.

Its like you read my mind! You seem to know a lot about this, like you wrote the book in it or something. I think that you can do with some pics to drive the message home a bit, but other than that, this is excellent blog. A great read. I will certainly be back.

Valuable info. Lucky me I discovered your web site by chance, and I’m surprised why this accident didn’t took place earlier! I bookmarked it.|

Thanks for any other informative web site. Where else may I am getting that type of info written in such a perfect way? I have a undertaking that I’m just now working on, and I’ve been on the glance out for such info.|

Thank you, I’ve just been looking for info about this topic for ages and yours is the best I’ve discovered till now.